In the rapidly evolving digital landscape, managing personal finances has become more accessible than ever before, largely thanks to the proliferation of Financial Technology (Fintech) applications. The global shift towards greater financial awareness, accelerated by recent events like the pandemic, has fueled the rise of “frugal living” – a lifestyle centered around making informed and economical decisions regarding money and resources. Essentially, frugal living is about maximizing your financial efficiency and carefully managing your funds.

The Fintech market reflects this growing demand. Statista projects a substantial reach for the global fintech market, anticipating it to hit USD310 billion by 2025 – just next year. This surge in growth signifies an increasing reliance on digital solutions for money management. For individuals seeking to gain control of their finances or embrace a frugal lifestyle, numerous powerful Fintech apps are available. Let’s delve into some of the best options for effective financial stewardship.

Before exploring specific applications, it’s crucial to understand the underlying philosophy of frugal living. It isn’t about deprivation; rather, it’s a conscious choice to prioritize value and intentional spending. This involves:

A. Mindful Spending: Evaluating each purchase based on need versus want, and prioritizing long-term financial goals over immediate gratification.

B. Budgeting & Planning: Creating a detailed budget that aligns with your income and expenses, allowing for savings and debt reduction.

C. Resourcefulness & DIY: Finding creative ways to save money by utilizing existing resources, learning new skills (like home repairs), and avoiding unnecessary purchases.

D. Debt Management: Developing strategies to minimize and eliminate debt, freeing up financial resources for other priorities.

E. Long-Term Thinking: Focusing on building wealth and securing your financial future through investments and smart financial planning.

Fintech Apps: Your Digital Financial Allies

Here’s a detailed look at some leading Fintech apps designed to help you implement these principles:

1. Mint App: The All-in-One Personal Finance Hub

Mint is consistently ranked among the top personal finance applications, and for good reason. Its strength lies in its comprehensive features and user-friendly interface, making it an invaluable tool for anyone seeking financial control.

The app provides a centralized overview of your entire financial situation by securely linking to your credit cards, debit cards, bank accounts, and investment accounts. It automatically categorizes transactions, providing clear insights into your spending habits. This allows you to identify areas where you can cut back and optimize your budget. Mint doesn’t just track; it empowers you to take action.

Key Features:

- Expense Tracking: Automatically categorize transactions and visualize spending patterns with detailed charts and graphs. Mint utilizes sophisticated algorithms to accurately classify expenses, saving you time and effort.

- Budgeting: Create personalized budgets based on your individual spending habits and financial goals. You can set limits for various categories (groceries, entertainment, transportation) and receive alerts when you’re approaching or exceeding those limits.

- Bill Reminders: Avoid late fees with timely reminders for upcoming bills. Mint allows you to track due dates and payment amounts, ensuring you stay on top of your financial obligations.

- Credit Score Monitoring: Monitor your credit score for free and receive personalized tips on how to improve it. Understanding your credit score is crucial for accessing loans, mortgages, and other financial products at favorable rates. Mint provides valuable insights into factors affecting your creditworthiness.

- Investment Tracking: While primarily a budgeting app, Mint also allows you to track your investment portfolio, providing a holistic view of your finances.

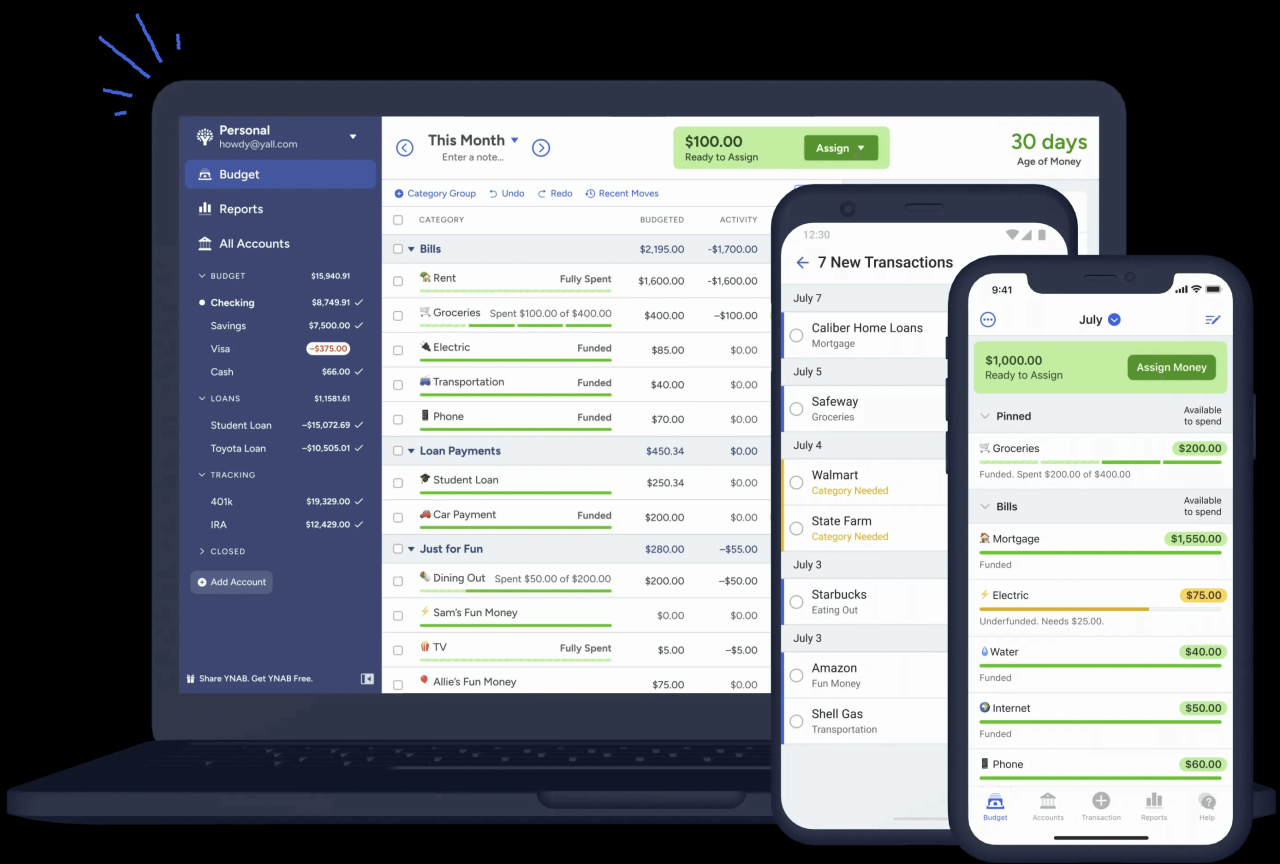

2. YNAB (You Need A Budget) App: Proactive Financial Planning

YNAB takes a different approach to budgeting compared to many other apps. Instead of simply tracking past transactions, it focuses on proactive financial planning and allocating every dollar you earn. This is based on the “zero-based budgeting” system, where your income minus your expenses equals zero.

This method forces you to be deliberate with your money, assigning a specific purpose to every dollar before you spend it. YNAB isn’t just about restricting spending; it’s about making conscious choices that align with your financial goals. It encourages users to think ahead and plan for future expenses, rather than reacting to them.

Key Features:

- Goal Setting: Define and track your financial objectives, such as saving for a down payment on a house, paying off debt, or building an emergency fund. YNAB helps you break down large goals into manageable steps.

- Real-Time Tracking: Sync your accounts in real-time to monitor where your money is going and adjust your budget accordingly. This provides immediate feedback and allows for greater financial control.

- Educational Resources: Access workshops, webinars, and educational materials designed to improve your budgeting skills and financial literacy. YNAB emphasizes education as a key component of successful financial management.

- Rule-Based Budgeting: YNAB utilizes four simple rules: Give Every Dollar A Job, Embrace Your True Expenses, Roll With The Punches, and Age Your Money. These rules provide a framework for effective budgeting and financial planning.

3. Acorns App: Investing Made Easy with Spare Change

Acorns simplifies investing by allowing you to invest your spare change from everyday purchases. The app rounds up each purchase to the nearest dollar and invests the difference into a diversified portfolio of Exchange-Traded Funds (ETFs).

This makes investing accessible even for beginners who may not have large sums of money available. Acorns is an excellent way to start building wealth gradually, without requiring significant upfront investment. For just USD3 per month, you can begin growing your investment portfolio effortlessly.

Key Features:

- Round-Ups: Automatically invest the spare change from purchases made with linked credit or debit cards.

- Found Money: Earn cashback rewards from participating retailers and have them automatically invested into your Acorns account.

- Recurring Investments: Set up regular contributions to accelerate the growth of your investment portfolio.

- Educational Content: Access articles, videos, and other resources to learn more about investing and financial planning.

- Portfolio Options: Choose from a range of pre-built portfolios based on your risk tolerance and investment goals.

4. Personal Capital App: Comprehensive Financial Management

Personal Capital offers a suite of tools for budgeting, investment tracking, and retirement planning, making it a comprehensive solution for managing your finances. What sets Personal Capital apart is that many of its features are available free of charge.

The app provides detailed insights into your income, spending, and savings habits. It categorizes your expenses, allowing you to understand where your money is going. You can also plan your spending by reviewing minimum payments and due dates for bills and credit card statements. Personal Capital’s budgeting tools are designed to help you stay organized and in control of your finances.

Key Features:

- Net Worth Tracking: Link all your financial accounts (bank accounts, investment accounts, loans) to track your overall net worth.

- Investment Checkup: Analyze your investment portfolio and receive personalized recommendations for improvement. Personal Capital’s Investment Checkup tool identifies potential areas of concern and suggests strategies to optimize your portfolio.

- Retirement Planner: Plan for your future by utilizing detailed projections and scenarios. The Retirement Planner helps you estimate how much you need to save to achieve your retirement goals.

- Cash Flow Management: Monitor your income, expenses, and cash flow in real-time. This provides a clear picture of your financial health and allows you to identify areas for improvement.

Embrace the Power of Fintech for Financial Freedom

By leveraging these digital tools, you can take control of your financial future, make informed decisions, and achieve your financial goals.

Start implementing frugal living principles today by exploring these apps and streamlining your financial management. Secure your financial well-being and unlock a brighter financial future with the power of Fintech.